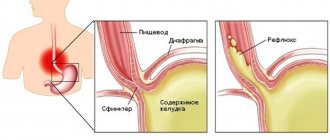

Vaginal sanitation is a procedure that is performed not only in a hospital inpatient department. The technique is successfully used at home with proper skill and special medications prescribed by the doctor. They are antiseptic medications that will need to be used to treat a woman’s external genitalia.

Manipulation is part of a complex treatment aimed at reducing any inflammatory process localized in a delicate area. The same approach is used before childbirth, or as preparation before surgery.

What is rehabilitation?

Rehabilitation usually refers to a set of measures aimed at restoring the solvency of a bank and improving its financial condition. The main goal of reorganization is to increase the efficiency of the credit institution and restore its competitiveness in the market, which is a prerequisite for avoiding bankruptcy. One of the main provisions of the Federal Law of the Russian Federation No. 40-FZ “On the insolvency of credit organizations” is the recognition of the legal equality of several procedures, in particular, reorganization, the appointment of a temporary manager as the first stage of bankruptcy and reorganization.

One of the conditions for bank reorganization is the identification of an investor for its implementation. Its tasks include not only carrying out activities aimed at increasing the efficiency of the bank, but also, most importantly, allocating additional financial resources. As practice has shown, not all banks that were appointed as investors, that is, sanators, to carry out measures to improve problem credit institutions in 2013-2014, coped with the task. Moreover, at least two of them - the already mentioned Bank Otkritie and Binbank - today themselves are in need of reorganization by the Central Bank.

Carrying out activities during the reorganization of enterprises

Activities during the reorganization of an enterprise include financial, economic, production, technical, organizational and legal actions aimed at achieving or restoring the solvency, profitability and competitiveness of the debtor company for the long term. When carrying out reorganization, the main ones are considered to be measures of a financial and economic nature.

Financial and economic events reflect the features of financial relations that arise in the process of mobilization and use of internal and external sources of enterprise reorganization. These may be funds received under the condition of a loan (refundable or non-refundable).

Financial rehabilitation of enterprises most often includes several stages, with the main goal being:

- Covering current losses and eliminating (eliminating) their causes.

- Restoring or maintaining the liquidity and solvency of the company.

- Reducing all types of debt.

- Improving the working capital structure.

- Formation of funds of financial resources necessary for carrying out production, technical and organizational activities.

Reorganization of an organizational or legal nature frees the enterprise from unproductive production structures and improves:

- organizational structure of the enterprise;

- organizational and legal form of doing business;

- quality of management;

- relations between members of the work team.

Signs of a problematic bank situation

Article 4 of the above-mentioned No. 40-FZ provides a clear description of the grounds sufficient to prescribe a reorganization procedure. These include:

- failure to comply with creditors' demands for payment of obligations during the last 6 months;

- impossibility of making a payment within 3 days due to the lack of funds in the bank’s correspondent accounts;

- non-compliance with the standards established by the Central Bank in relation to current liquidity by more than 10% per month, as well as in terms of solvency indicators and the minimum capital of a credit institution;

- a reduction in the amount of capital by 20% or more compared to the maximum amount of this parameter for the previous year;

- reduction of the bank's capital for the reporting period to a level that is lower than established by the constituent documents of the organization (for banks operating on the market for more than 3 years).

If any of the above factors are identified, the bank management is obliged to begin reorganization. In addition, the relevant information must be communicated to the market regulator, that is, the Central Bank of Russia. If these violations were identified directly by Central Bank specialists during the implementation of control functions, the bank is either issued an order to eliminate them, or a forced reorganization procedure is introduced. Until recently, two options were used to carry it out:

- using funds from the DIA, that is, the Deposit Insurance Agency;

- by appointing as a sanator another bank that has funds sufficient to rehabilitate a problem credit institution.

However, in July 2022, the Central Bank of the Russian Federation announced the launch of a third possible rehabilitation scheme using funds from the newly created Consolidation Fund, the main role in which will be played by representatives of the Central Bank itself. This is exactly the scheme that is currently being used to rehabilitate B&N Bank and Otkritie Bank.

Feasibility of treatment

Performing sanitation is important for maintaining healthy teeth throughout life. The need for such procedures is relevant at any age and will allow you to forget about toothache for a long time. Our doctors will explain the importance of all procedures to restore oral health and provide the necessary treatment. Professional sanitation of the oral cavity performed in our clinic will be the key to healthy teeth and provide a delightful smile.

This article is for informational purposes only, please consult your doctor for details!

Reasons for reorganization

In addition to the criteria described above related to the financial condition of the bank, two significant factors may serve as the basis for making a decision on resolution:

- serious importance of the bank in the financial sector of the country. This means that the bankruptcy of a credit institution can cause significant harm to the Russian banking system, which can lead to problems in other banks;

- The bank's difficulties are temporary and unsystematic in nature and can easily be eliminated with a reasonable level of investment on the part of the owners of the credit institution or sanatorium.

In most cases, reorganization is applied to those financial structures that have been operating on the market for quite a long time and have an established reputation and status. If we are talking about a newly opened or small bank, most often the Central Bank of Russia simply revokes its license, thus stopping its activities.

Expert analysis

In order to make a final decision on pre-trial rehabilitation, it is necessary to thoroughly check the financial condition of the debtor. This happens in order to come to economically correct conclusions about the possibilities of restoring the solvency of the enterprise within a certain period of time without initiating bankruptcy proceedings with an appeal to the arbitration court.

The expert analysis is carried out by a group of representatives of independent auditing or consulting firms. By-laws and instructional materials regulate current liquidity ratios, securing current assets using own funds, and restoring the ability to pay payments.

As practice shows, the indicators that were adopted as criteria cannot fully reflect the current financial condition of the company, because they depend on what industry the enterprise belongs to. The experience of implementing such practices indicates that the standard values of some indicators can be determined by looking at the industry of the debtor company. This data is used to analyze the situation, and not to make a decision regarding reorganization.

As a rule, reorganization is carried out based on the capabilities of one of the following external sources:

- Merger of a company with another, more powerful enterprise.

- Issuing new securities to raise money capital.

- Increasing bank credit and receiving subsidies.

- Reducing the payment on a bond and deferring its repayment.

- Full or partial purchase by the state of shares owned by an enterprise.

In addition, financial rehabilitation can also be carried out by attracting funds from the owners of the company, the largest creditors or personnel working at the enterprise.

Who benefits from this?

Successful bank resolution benefits absolutely all participants in the process. The credit institution begins to operate effectively as normal again. The sanator gets the opportunity to return the investment with a profit. Clients of the bank being rehabilitated retain funds in their accounts, and in full, and not in accordance with the limit established by the DIA. The interest and benefit of the country's Central Bank is also quite obvious - the state's financial system is becoming more stable. Even the competitors of a struggling bank benefit from successful reorganization, as it maintains customer confidence in the entire banking system of the country.

The only problem is that not every sanitation procedure initiated is completed successfully. In this case, the exact opposite picture described above is observed. The sanatorium loses its invested funds, and, as the examples of B&N Bank and Otkritie Bank clearly showed, it can itself find itself in a difficult financial situation. The owners of the bank being rehabilitated will lose their own business, since the Central Bank of the Russian Federation will most likely revoke the license as a result. Some of the bank's clients lose funds; only the owners of deposits are guaranteed to return them from the accounts of the Deposit Insurance Agency, the amount of which, together with accrued interest, does not exceed 1.4 million rubles.

Concept

Even healthy teeth require constant care to maintain their natural beauty. Age-related changes, previous illnesses or irregular hygiene procedures complicate the dentist’s work. This situation is typical for most people, and the possibilities of aesthetic medicine make it possible to eliminate a huge part of such shortcomings. Incorrect positioning of teeth, their damage or absence can be corrected by sanitation of the oral cavity. The implementation and order of the necessary procedures are determined individually and may require several visits to the dentist.

Sanitation of the oral cavity

– is a set of measures aimed at correcting all defects of the oral cavity. Treatment of gums and teeth, dental orthopedics and prosthetics are the most important areas in such recovery. After completing all the necessary procedures, the patient receives completely healthy teeth and an aesthetically perfect dentition. Oral sanitation is not a one-time procedure and is carried out throughout life. This approach will provide an opportunity to prevent the development of dental diseases, which will have a positive impact on health and the cost of dental services.

Ways to improve your health

The reorganization procedure provides for two main areas of work carried out by the Central Bank of the Russian Federation, the DIA or the sanator appointed by them:

- allocation of additional financial resources;

- selection of financial stabilization methods and their implementation.

Funding for economic recovery activities can occur in a variety of ways. Until recently, the most frequently used options were:

- use of funds from bank owners. The most calm and effective solution to the problem;

- provision of direct financial assistance from the DIA or Central Bank of the organization being reorganized;

- use of funds from a sanatorium designated for the treatment procedure;

- provision of funds from the DIA or Central Bank directly to the sanatorium.

Quite often, during the recovery procedure, all of the listed methods of providing financial assistance are used. However, until recently, it was not allowed to completely reorganize at the expense of the budget and the DIA. At the same time, the procedure introduced at Otkritie Bank and Binbank, which provides for the use of funds from the Consolidation Fund, may become the first example of how reorganization will be carried out, in fact, entirely at the expense of the budget. In this case, it does not matter at all whether this will be done through the reorganization of a credit institution or by entering into the capital of the bank being rehabilitated by purchasing its shares.

Medication classification

The algorithm for carrying out the procedure remains identical at home and in the inpatient department of the hospital. For the first time, a doctor can show you how to do everything according to the instructions. Then the woman will be able to repeat everything at home without outside help.

The most important thing at this stage is to use only the products recommended by your treating specialists, without changing the procedure, dosage or number of times. A good medicine that is designed to help in a short time must have a number of qualities that enhance its effectiveness:

- performance;

- antifungal work;

- antimicrobial protection;

- antiviral protection.

The medication will have a pronounced effect against protozoa. But at the same time, the increased activity of the drugs should not be stopped by purulent or bloody discharge, if it comes to that.

Schematically, all antiseptics can be divided into three broad camps: narrow therapeutic focus, multicomponent formulations, and agents with a nonspecific spectrum of action.

All of them are suitable for different clinical cases, sometimes requiring combination with other drugs. The first category is considered gentle and effective at the same time. But you can use medications from there only after tests have been carried out with clearly defined results. Only with their help will it be possible not to miss the diagnosis.

But since it is often difficult to quickly identify a specific lesion, doctors prefer to play it safe by prescribing a remedy with a strong active ingredient. But such productivity will have to be paid for by inhibiting the development of lactobacilli.

Nonspecific drugs are often confused with narrow-profile representatives of the pharmacological market, but these are two different categories.

Nonspecific analogues work selectively, protecting other organs from their effects. But even here everything is not too rosy, because they often provoke an allergic reaction.

Today, pharmacists have moved forward, offering new solutions almost every year that make it possible to work on destroying the original source of the gynecological problem during sanitation really quickly.

At the same time, new generation liquids, which are used according to the scheme, are able to act against several types of microorganisms at once. And lactobacilli will remain fine. Suppositories based on solutions later began to appear, which are much easier to administer independently, using tampons as a template.

Problem solving methods

The second area of work during bank reorganization is the determination of the main methods for increasing the competitiveness of a credit institution in the market and the efficiency of its work. A variety of measures can be used for this, the most famous of which are:

- restructuring of the bank's accounts payable. Most clients understand perfectly well that it is much more profitable to wait a little to submit claims if there is at least a small chance of restoring the bank’s functionality. When declaring bankruptcy, the likelihood of getting your money back is noticeably lower;

- sale of illiquid assets on the bank’s balance sheet;

- optimization and reorganization of the bank's management and management system. The previous system has proven to be ineffective, so it should be replaced with a more efficient one;

- staff reduction, closure of unprofitable branches and branches. In modern conditions, when an increasing number of clients prefer remote working methods, there is no need to maintain a large number of offices;

- introduction of modern working methods, including using the Internet, and optimization of costs at all levels.

Types of bankruptcy procedures

If a legal entity loses the ability to pay obligatory payments, an insolvency procedure may be applied to it. Depending on the economic situation of a potential bankrupt, federal legislation defines the types of bankruptcy procedures used in relation to the defaulter.

Bankruptcy concept

The very concept and procedure of bankruptcy arose in ancient Rome and concerned bankrupt moneylenders. Businessmen made their transactions on special benches, which broke down in case of ruin. The modern term bankrupt comes from the phrase banca rotta.

Today, this is a normal tool in the global economy, allowing us to “clean out” from the list of registered legal entities those that have long lost their viability, and to free creditors from part of the tax base by writing off bad debts.

The concept and signs of bankruptcy, as well as the bankruptcy procedure itself, described in the law, have remained unchanged since 2002 (for enterprises) and since 2015 (for citizens). In 2022, an innovation appeared in the legislation regarding the declaration of insolvency of low-income categories of the population.

Signs for declaring insolvency

To declare incapacity as a legal entity, a business must meet the following conditions:

The total debt to the budget, suppliers, banks, employees, and so on is from 300 thousand rubles. No mandatory payments for 90 days. An amount of assets that is not sufficient to satisfy financial claims. In the presence of the listed circumstances, filing an application with the court is the responsibility of the company management.

Liquidation of an enterprise is not the only purpose of initiating the procedure. During the judicial review, measures are developed to restore the debtor’s solvency, and signs of fictitious or deliberate bankruptcy are identified.

As for the bankruptcy case of an individual, the procedure is aimed both at freeing the citizen from unsustainable debt, and at preserving his property through the implementation of a restructuring plan. To begin arbitration proceedings for the bankruptcy of a citizen, including those with the status of an individual entrepreneur, the court checks the presence of the following conditions:

There are outstanding claims in the amount of half a million rubles. At the time of filing the application, payments on obligations were overdue by 3 months. Insufficient available property and income to pay off the company’s debts and restore its solvency. From the moment the legal proceedings begin, an arbitration manager is included in the case, whose services the debtor is obliged to pay. By the beginning of the hearing, the first payment in the amount of 25 thousand rubles must be paid to the court deposit.

Extrajudicial procedure

The concept and procedure of bankruptcy taking place out of court requires compliance with the following characteristics:

The amount of debt for utility bills, loans, alimony, etc. is from 50,000 to 500,000 rubles. Closed enforcement proceedings against the debtor. The debtor lacks property on which foreclosure can be imposed. According to the Bankruptcy Law, to initiate a simplified procedure, a citizen must contact a multifunctional center (it does not matter whether the MFC is related to the applicant’s registered address). You need to have your passport with you; the application must be filled out on the spot. The document contains a list of persons to whom there is a debt. Creditors not included in the list can assert their claims through the court. In this case, the out-of-court procedure will be terminated, and the Arbitration will take over the matter.

It happens that debtors deliberately do not indicate in the application all the persons to whom there are debts in order to take advantage of the “simplified procedure”. If the entities to whom the potential bankrupt is indebted are not included in the application and do not appear in court to make claims, the debt to them will not be written off. Repeated bankruptcy in a simplified form can be initiated after 10 years.

Types of legal entity insolvency procedures

Russian legislation describes the following types of bankruptcy procedures regarding the financial insolvency of a legal entity:

Observation procedure. Stage of financial recovery. External control stage. The bankruptcy procedure. To terminate the trial early, the possibility of signing a settlement agreement between the parties has also been developed. The document can be drawn up at any stage of the proceedings, up to a decision to declare the entity bankrupt.

The settlement agreement is aimed at repaying the debt to the parties in proportion to the requirements. If there are clauses in the contract that infringe on the interests of one or more participants, the court may refuse to complete the procedure.

Observation The observation procedure, lasting up to 7 months, is aimed at analyzing and assessing the economic condition of a potential bankrupt and identifying reserves that can be used to revive the company. To begin with, the arbitration specialist informs all entities specified in the insolvency application about the start of the trial. It is also mandatory to publish information in the EFRSB and Kommersant.

Analyzing the condition of the debtor's main assets, the specialist applies economic methods. For example, it draws up a profitability graph, raises property transactions, studies the policies of managers in order to identify what was the impetus for the deterioration of the subject’s financial position.

Once the monitoring phase begins, creditors have 30 days to register their claims by entering them into the register. If during this time the entities were unable to express claims, creditors have 2 months at the stage of bankruptcy proceedings. Only the chances of receiving payments in this case are reduced.

With the start of arbitration proceedings, the accrual of fines and penalties ceases, and a number of restrictions are introduced in relation to the debtor. During surveillance, the manager has the right to request all company documentation, including confidential ones. Upon completion of the stage, the arbitration specialist schedules a meeting of creditors, at which he provides a financial report and a list of recommendations for the further course of the process. The decision is made based on the voting results of the meeting participants.

Measures to restore solvency If the arbitration manager was able to convince the meeting participants of the possibility of restoring the subject’s vital activity, the stage of financial recovery can begin. This is a resuscitation procedure and the concept of bankruptcy, lasting no more than two years. During the reorganization process, the director remains at the helm of the company, but with somewhat limited powers.

A whole system of restrictions applies to the manager:

ban on applying for loans; veto on surety; moratorium on property transactions if the value of the contract is higher than 5% of the principal amount of assets; prohibition on payment of dividends. The purpose of financial rehabilitation is to fully satisfy the claims of creditors and restore the ability to conduct full-fledged activities.

Another type of resuscitation procedures that are effective in the bankruptcy process is the introduction of external management. If illiterate or negligent management has led to a decline in the company's solvency, the director is removed from office for the duration of the procedure, and an external manager takes his place.

The anti-crisis specialist has the right to dispose of the debtor’s main assets. For example, he can rent out part of the space or sell vehicles that are on the bankrupt’s balance sheet. The manager also has the right to initiate the issue of securities, dismiss part of the staff, change the debtor’s activity profile, and introduce a new management system. The specialist reports to creditors for decisions made. At the end of the stage, the trial is terminated or moves to the final stage - bankruptcy proceedings.

If, in the course of his activities, the temporary manager discovers signs of fictitious or deliberate bankruptcy, the procedure is terminated, and a petition is submitted to the judge to initiate legal proceedings on the fact of false or deliberate insolvency. Such acts are punishable by a fine of 100 thousand rubles, forced labor or imprisonment for up to six years.

Simplified procedure

As with regard to individuals, the concept and procedure of simplified bankruptcy may also apply to an enterprise. We are talking about processes in which the observation stage and resuscitation procedures are skipped, and the court immediately orders bankruptcy proceedings. The system is used in relation to non-performing companies, on the balance sheet of which there are not enough assets to restore viability, and there is no way to find management.

Such debts lie like a dead weight on the shoulders of creditors and tax authorities, accumulating fines with no prospect of repayment. An application to declare a legal entity bankrupt is submitted by representatives of the Federal Tax Service, banks, and partners to whom the debt has arisen.

In a simplified form of bankruptcy of an organization, after the application is accepted, an arbitration manager is appointed, who forms the bankruptcy estate, sells the property and consistently satisfies the claims of the applicants. Although practice shows that the funds are barely enough to cover legal costs and pay the bankruptcy trustee.

The law outlines the procedure for liquidating a company in a simplified form. To do this, the founders must make a decision to terminate the company's activities and appoint a liquidation commission. An application for liquidation is drawn up by a notary, after which the responsible person (liquidator) draws up a liquidation balance sheet and transmits the information to the Federal Tax Service. Within 10 days after drawing up the application, a claim to declare the legal entity bankrupt under a simplified procedure is sent to the Arbitration Court.

Bankruptcy with liquidation does not include the stages of supervision, financial rehabilitation and external administration. The case immediately moves into the bankruptcy proceedings stage.

Certain categories of bankrupts

Federal Law No. 127, which explains what bankruptcy procedures and stages exist, separately defines the procedure for recognizing the insolvency of a developer company, municipal unitary enterprises, as well as certain categories of legal entities. These include city-forming companies, strategic and agricultural enterprises, and natural monopolies.

The concept and procedure for bankruptcy of a developer takes place in the shortest possible time (up to 18 months), since it is directly related to the return to shareholders of their housing or money invested in construction. Monitoring and financial recovery are not introduced; an external management procedure is possible, but in exceptional cases. Most often, the process immediately goes into bankruptcy proceedings, as a result of which the claims of the parties are satisfied and the remaining debts are cancelled.

When considering the insolvency of enterprises classified as a separate category, legal proceedings can last for years. Bankruptcy proceedings alone last up to 3 years, and in special cases can last up to 10 years. The main task of the state in the event of bankruptcy of city-forming, strategic, agricultural enterprises is to preserve the integrity of the object for its further restoration and activity, albeit under different details. Therefore, assets are sold only comprehensively, with 50% of the staff retained.

Conducting bankruptcy proceedings All types of bankruptcy procedures taking place in the Arbitration Court have one thing in common - the signs and presence of the bankruptcy proceedings stage in the event that it was not possible to restore the insolvency of the entity. At this stage, a bankruptcy trustee is included in the work, whose candidacy is approved by representatives of the meeting of creditors.

The algorithm of actions is as follows:

Conducting an inventory of the bankrupt's assets. Selecting an electronic trading platform on which the auction will be held. Notifying participants in the process about lots and ETP. Monitoring compliance with sales rules. Formation of a sequence of payments. Repayment of debts in the order specified by law. Drawing up a report on the results of the auction and submitting it to the judge. Some of the claims for which the proceeds were not sufficient to repay are declared written off. An enterprise that is declared bankrupt is deleted from the Unified State Register of Legal Entities forever.

Nuances of bank management during reorganization

The only option in which the management of the bank remains in the hands of its owners and the managers appointed by them is the case when the reorganization occurs on the initiative of the credit institution itself. If the decision to introduce a financial recovery procedure is made by the Central Bank of the Russian Federation, it is he who appoints a temporary administration to manage the bank. It usually consists of representatives of the Bank of Russia itself, the DIA and an organization appointed by the sanatorium. It is important to note that the temporary manager has the right to challenge and cancel even those financial transactions that were concluded before his appointment.

Why don't all banks rehabilitate?

Sanitation is a complex procedure. Its implementation requires time, finances, and the involvement of highly qualified experts. Therefore, not all banks undergo rehabilitation. To do this, you must meet the following requirements:

- Systemic significance of the problematic institution. If a bank is important for the financial market of an entire country or region, and its collapse could lead to a loss of confidence in banks as a whole on the part of customers, the likelihood of resolution is high. The chances increase when government funds or funds from large companies and foundations are placed in its accounts.

- Compliance with legal requirements. Recovery is likely if the bank conducted honest activities in relation to the regulator and clients and acted as a financial intermediary between investors and borrowers.

- Availability of economic justification. Before starting the procedure, the Bank of Russia assesses the upcoming costs. If the financial institution is not significant or cannot be rehabilitated, resolution is neither practical nor likely. In this case, bankruptcy proceedings begin, which is accompanied by revocation of the license.

ATTENTION!

Resolution is not only aimed at saving one specific financial institution. Its main direction is to maintain the stability of the entire banking system. Each case is considered individually. The regulator preliminarily assesses the possible consequences for clients and the entire market. If he believes that the reorganization does not have good grounds, revocation of the license is inevitable.

Features of reorganization in Russia

The Russian banking sector is characterized by a fairly large number of attempts to reorganize even not the largest and most significant credit institutions in the country. Naturally, there is a clear connection between the number of banks being rehabilitated and the current financial situation in the country. For example, during the 2008-2009 crisis, the Central Bank decided to introduce a financial recovery procedure in 14 credit institutions. During the relatively stable financial period from 2010 to 2013, the reorganization of only 2 banks was announced.

After the introduction of sanctions against Russia and a serious deterioration in the economic situation in the country in 2014 and 2015, the financial recovery procedure was prescribed in 12 and 15 credit institutions, respectively. In 2016, the situation as a whole did not change, and in the third quarter of 2017, two banks included in the top 15 largest financial organizations in the country, namely Otkritie Bank and B&N Bank, came under reorganization. This was largely a consequence of the main domestic feature of the financial recovery procedure, which consists in a relatively small percentage of successfully completed reorganizations.

☛ How is vaginal treatment done?

At our clinic, gynecologists carry out the procedure for sanitizing the vagina and external genitalia in women and girls (sanitation) as follows. The drugs that are used in our work are not only well-known and, in some cases, proven to work well, miramistin and chlorhexidine. Our patients are offered modern imported antiseptic drugs that act effectively and quickly, have antimicrobial, antifungal, antiviral properties, and have a pronounced anti-inflammatory effect.

The doctor’s sequence when performing vaginal sanitation manipulation is as follows.

- Immediately before the procedure, the woman needs to empty her bladder and bowels.

- Undress below the waist and sit on the gynecological chair, closer to the edge, with your legs spread wide apart and slightly pulled up to your stomach. This position will make it easier to insert instruments and allow solutions to better act on the side walls.

- The external genital organs are treated with antiseptics, all folds and areas of the labia minora, urethra and clitoral pocket are affected (the space between the clitoral head and its hood; a frequent place for the accumulation of any discharge).

- A gynecological speculum is inserted into the vaginal cavity as deeply as possible and fixed with a stop. The vagina is cleaned of leucorrhoea with a cotton swab, after which antiseptic solutions are poured inside one by one (the so-called “vagina baths”). Process again and remove any remaining accumulated secretions. After undergoing several sanitation cycles, the expander is removed.

- After thorough rinsing and a bath, special antimicrobial creams/ointments are applied to the vagina and external genitalia, and the external labia are covered with a sterile gauze cloth.

Powers of regulatory authorities

The main functions of control over the activities of banks are assigned to the Central Bank of the Russian Federation, which can make decisions on the need for reorganization, revocation of a license or issuing orders to eliminate violations. For carrying out financial stabilization measures, the position of the DIA, whose funds can be allocated for the reorganization procedure, becomes important. If the DIA refuses to provide financing, the most likely decision of the Central Bank of the Russian Federation will be the revocation of the license and the subsequent bankruptcy of the problem bank.

Where else can the sanitization procedure be applied?

The resolution procedure can be applied not only to banks. This measure is provided for enterprises of any type. It entails changes not so much in the material sphere as in the legal one.

A diversified enterprise is subject to a merger with another company with a similar focus. In other cases it is divided into segments. Often an enterprise is privatized or transformed into an OJSC.

ATTENTION!

Resolution is only used in cases where the company can be saved. If the company is hopeless, bankruptcy proceedings are applied to it. This process is controlled by the arbitration court.

The role of the Central Bank and the Deposit Insurance Agency in the process of bank recovery

When carrying out reorganization, the Central Bank and the DIA exercise control at all stages of the procedure. In addition, an important function of the Central Bank is the selection and appointment of a sanator, that is, a large bank that has a stable financial position and has sufficient resources to help a problematic credit structure. The events of recent months have shown that the Bank of Russia did not always make the right decisions, appointing FC Otkritie as the sanator of Bank Trust in 2014 (at the same time, the DIA allocated 157 billion rubles), and Binbank in the same 2014 as the sanator of the banks of the Rost and Bank Credit systems. As a result, problematic financial structures were saved from bankruptcy, however, serious difficulties began for the banks themselves that carried out the reorganization.

How are cupping treated?

In simple terms, resolution means the transfer of a financial institution to another owner or investor. It can be any large bank or even the Bank of Russia itself.

The procedure involving a commercial sanator is called “credit”. The new owner is given a grace period during which he rehabilitates the bank. The period for restoring financial stability is quite long. On average it reaches 10–15 years. Full restoration occurs at the final stage, when the bank begins to operate at full capacity in compliance with all legally established standards.

There is a second sanitization option. In the Russian Federation it has been used since 2017. This method involves direct investment by the Bank of Russia into the capital of a problem financial institution through the Banking Sector Consolidation Fund.

ATTENTION!

When using the second method, recovery occurs in record time (up to 1 year) with minimal costs.

Pros and cons of reorganization for the investor

For a depositor of a troubled bank, successful resolution can be extremely important. This is explained by the fact that with an alternative option, that is, a bankruptcy procedure, there is a high probability that a significant part of the bank’s clients simply will not be able to receive the invested funds in full. Typically, this development of events is associated with a lack of bank assets to pay off all its accumulated debts.

Bank depositors who are individuals can count on a guaranteed receipt of funds in an amount not exceeding 1.4 million rubles, including accrued interest. The chance of receiving anything more than the specified amount during bankruptcy proceedings is quite small. Moreover, it usually extends over a long period, while payment from DIA funds is made within 2 weeks after the start of bankruptcy or liquidation of the bank.

Considering the above, it becomes clear why successful reorganization is extremely important for investors, especially large ones. In this case, their relationship with the bank will continue on the same terms, which will allow them to save and even increase funds on deposits.

Indications and contraindications

The average woman is faced with the need to cleanse the vagina before genital surgery. But in most cases, junior staff does this for her, since the victim herself is already under the influence of anesthesia.

Many gynecologists insist on the need to perform similar actions during pregnancy in order to protect against the possible development of a strong inflammatory process. The regularity of procedures should be clarified during the next preventive examination by a gynecologist in the antenatal clinic.

When a microbial agent travels from the vagina directly into the uterus after the placenta is separated, the likelihood of a septic process increases. The risks even extend to the baby, who must pass through the birth canal and at the same time pick up a dangerous infection. If labor was extremely difficult, then you cannot do without sanitation even after childbirth.

The list of the most common prerequisites for prescribing sanitation includes several common diseases such as:

- bacterial vaginitis;

- sexually transmitted diseases;

- fungi;

- viral lesions;

- nonspecific viral conditions;

- local or large-scale inflammation of the gynecological organs located in the pelvis.

Sometimes manipulation improves the condition of some other anomalies associated with the reproductive system, but here you need to consult a specialist in each specific case separately. If you do everything according to simple instructions, then the effect will not take long to appear even in severe cases of the disease. This is confirmed by numerous reviews from patients who have experienced the effectiveness of the method.

The exact price of a course of therapy will directly depend on the duration of treatment, as well as the medications used in the treatment program approved by the gynecologist. Sometimes simple antiseptics, which are easy to find in any pharmacy, are enough.

But in case of rare anomalies, it is necessary to involve the introduction of vaginal suppositories, which cost more than standard preparations for washing.

Despite a whole bunch of medical indications, sanitation has several significant contraindications. Among them, pregnancy is especially highlighted, which, at the same time as the ban, is considered an indication. The confusion is caused by the fact that for women in an interesting position it is allowed to use rinses, but using instrumental techniques is strictly prohibited.

Other, more understandable indications include:

- inflammation at the acute stage of the course;

- menses;

- uterine bleeding;

- allergic reaction to an antiseptic;

- high body temperature;

- general serious condition.

To avoid the possibility of encountering anaphylactic shock, it is enough to conduct an allergy test in advance on a safe area of the skin.

If it turns out that the body does not take pharmacological drugs, you can look for an alternative. This is ultrasonic cleaning, which is offered by many modern clinics.

To mitigate the risks of possible infectious infection, the preparatory stage before hysteroscopy, colcoscopy, and oncocytology is never complete without sanitation. All three points provide for a detailed examination of the uterine cavity, where pathogenic microorganisms should not reach. Even standard installation of an intrauterine device does not occur without preliminary antiseptic treatment of the vagina.

When a woman, even if she is carrying a baby, is diagnosed with lesions of the genitourinary system, as happens with ureaplasma, the course of treatment will not be complete without sanitation.

Especially pregnant women should pay increased attention to personal hygiene in the early stages, as well as in the third trimester. For many expectant mothers, it is in the period from 34 to 36 weeks that Candida awakens. It is prohibited to suppress his vital activity using systemic methods, such as taking antibiotics or other medications, due to the likelihood of harming a young family member. Then sanitation will come to the rescue, which does not provoke swelling of the mucous membranes, protecting the birth canal from possible injuries.

Measures to prevent bank bankruptcy

When the first signs of financial problems appear, the bank’s management has the opportunity to independently take measures that will avoid not only bankruptcy, but also the introduction of a reorganization procedure. There are many different options for solving problems that arise:

- receiving financial assistance from the owners of a credit institution or their partners;

- development and implementation of a cost optimization program;

- changing the structure of the bank's assets and liabilities to bring them into compliance with the requirements of regulatory authorities;

- issue of bank shares in order to obtain additional financing, etc.

Practical measures to prevent bankruptcy can include any actions taken by the management of a problem bank, aimed at improving its financial condition and increasing operational efficiency.

Rehabilitation methods and requirements for the debtor company

Reorganization of enterprises is a financial and economic procedure that helps improve the condition of the company and prevent bankruptcy. There are several main methods of sanitation:

- the amount of share capital is reduced (decreased) by reducing the number of issued shares or exchanging shares for a large part of old shares;

- government subsidies, preferential loans, tax benefits are provided;

- the enterprise is being nationalized;

- antitrust laws are used, etc.

It should be noted that the debtor enterprise must:

- Prevent unproductive spending.

- Comply with creditor requirements as much as possible.

- Comply with the financial reorganization (rehabilitation mechanism) from the list of companies that have real potential for successful economic and financial activities in the future.

What funds are used to finance it?

Rehabilitation can occur at the expense of the following structures:

- Deposit insurance agencies. In this case, financing is provided from a fund formed by compulsory insurance of bank deposits;

- Central Bank of Russia. He can allocate funds both independently and when applying for a DIA in the form of a loan for a period of up to five years, issued without collateral;

- investors found by the Central Bank and DIA. Typically, the investor is a sanatorium appointed by the Bank of Russia, although funds from other commercial organizations can also be attracted.

How long does it last

There are no clear deadlines. Rehabilitation is a long process that can take 1-2 years or longer. The bank is gradually getting out of the financial hole, which takes time. There are examples when a bank was reorganized within 10 years. It all depends on how quickly the organization pays off the funds received.

It is difficult to say in advance how long it will take for financial recovery. It all depends on what position the bank is in. In some cases, rehabilitation is carried out faster, in others it takes a longer period.

Which banks are subject to the procedure?

The reorganization procedure is strictly regulated by the legislation of the Russian Federation. Financial recovery is carried out to avoid bankruptcy, when this is actually feasible.

The grounds for reorganization are the following:

1. The bank plays an important role in the state’s economy. The significance at the regional level is also taken into account; in most regions or republics there are local structures that have more weight than the federal ones.

2. The bank operates stably, its affairs are transparent, and temporary difficulties are not a system. Such situations are possible when investors, under the influence of the media, begin to panic and provoke an outflow of assets. As a result, the financial institution faces a lack of liquidity due to reasons beyond its control. In such cases, the state takes measures to save the bank so that it does not lose its license, and depositors do not lose their money.

Is it good or bad

For the credit institution itself, reorganization brings only advantages. Practice shows that after financial recovery, banks significantly change the direction of their activities, while simultaneously increasing capital turnover.

At the same time, the structure of the bank may also undergo changes. Among the most striking examples: the Bank of Moscow, which was subject to reorganization, subsequently became part of the VTB group. The result is the emergence of a completely new bank called VTB Bank of Moscow.

In this case, VTB acted as an investor, investing money in the financial rehabilitation of the Bank of Moscow. The merger of the two organizations served as a kind of dividend that was due to the investor.